In the ever-evolving landscape of financial fraud, terms like “mule account,” “money muling,” and “money mule” have gained significant attention, particularly in India. These fraudulent activities, involving unsuspecting individuals or organized groups, are a central component of money laundering schemes worldwide. In this comprehensive guide, we’ll explore what mule accounts and money mules are, how money muling works, the risks associated with it, and how to protect yourself from becoming an unintentional participant in these illegal operations.

Introduction to Mule Accounts and Money Muling

In the global fight against financial crimes, law enforcement and regulators are increasingly focused on “money mules”—individuals who help move illicit funds from one place to another, often without even realizing they are involved in illegal activities. This practice, known as “money muling,” is a key part of money laundering schemes, where criminals move dirty money across borders to disguise its origin. Mule accounts, on the other hand, are bank accounts used in these operations, typically controlled by unsuspecting individuals.

In India, as the digital economy grows and financial transactions increasingly shift online, the risks of becoming involved in a money-muling scam have risen exponentially. This post will guide you through everything you need to know about mule accounts, money muling, and how to protect yourself.

What Is a Mule Account?

A mule account is a bank account used to facilitate the transfer of illegally obtained funds, often without the account holder’s full knowledge. In many cases, individuals are approached by fraudsters and offered some form of compensation in exchange for using their bank account to receive and transfer money. While the person who owns the account may not always be fully aware of the illegal nature of the transactions, they are nonetheless complicit in the money laundering process.

Key characteristics of a mule account include:

- Unusual transaction activity: A large volume of transfers in and out of the account.

- Offered compensation: Account holders are often offered commissions for allowing their accounts to be used.

- Used in cross-border transactions: Mule accounts are often used to move money across borders, especially in international fraud and money laundering schemes.

What Is Money Muling?

Money muling refers to the act of transferring illicitly obtained funds from one person to another, typically through a network of intermediaries who are unaware or semi-aware of the criminal nature of the transactions. In this process, a money mule is someone who moves the stolen money on behalf of the fraudster, often in exchange for a small fee or commission. These individuals could be either knowingly or unknowingly involved in the crime.

Key features of money muling:

- Criminal facilitation: Mules help launder money for criminal networks.

- Layers of anonymity: Criminals use multiple mules to distance themselves from the origin of the illicit funds.

- Risk of legal repercussions: Even unwitting mules can face legal penalties.

How Do Money Mules Operate?

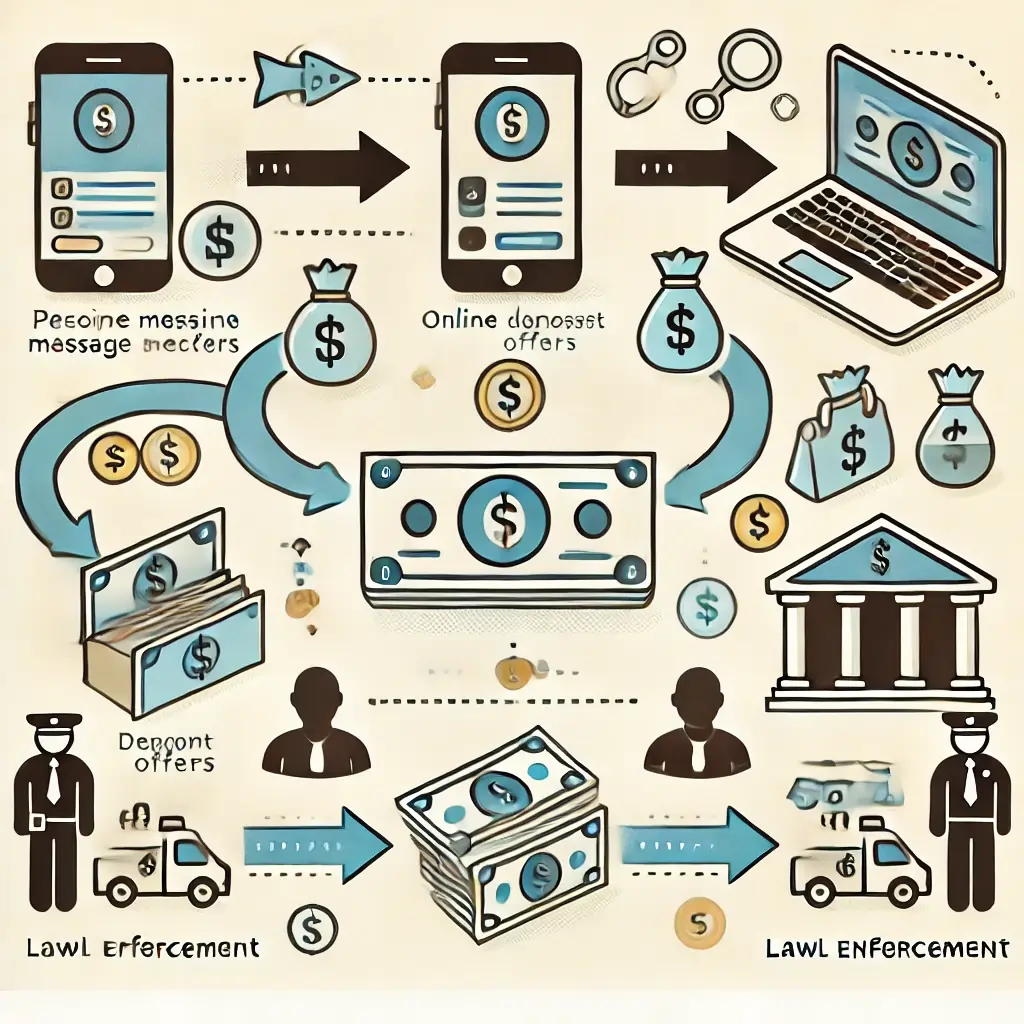

Money mules are typically recruited to move funds obtained through illicit activities, such as phishing attacks, online scams, or even ransomware payments. The process often follows this pattern:

- Recruitment: Mules are recruited via job advertisements, social media, or personal outreach. Some are told they will be “money transfer agents” or “payment processors.”

- Receiving funds: Mules allow their bank accounts to receive money from unknown or suspicious sources.

- Transfer: The mule is instructed to withdraw the money, keep a small percentage as a commission, and transfer the rest to another account, often through wire transfers or cryptocurrency exchanges.

At first glance, it may seem like a harmless or even legitimate activity. Still, in reality, the money being transferred is often tied to serious crimes, including fraud, drug trafficking, and terrorism financing.

Different Types of Money Mules

Money muling can be categorized into several types based on their awareness and involvement:

- Unknowing mules: These individuals are unaware that they are being used in illegal activities. They may believe they are engaging in legitimate business activities, such as working for a financial service company.

- Willing participants: Some mules know they are engaging in questionable activities but are willing to take the risk because of the monetary compensation offered.

- Complicit mules: These individuals are fully aware of their involvement in illegal activities and knowingly assist in the laundering of illicit funds for personal gain.

Why Do Criminals Use Money Mules?

Criminal organizations use money muling for several key reasons:

- To conceal the source of funds: Mules help obscure the origin of illicit funds by adding multiple layers of transactions, making it harder for authorities to trace the money back to its original source.

- To evade detection: Banks and financial institutions have strict monitoring procedures for large or suspicious transactions. By using mule accounts, criminals can split large sums into smaller transactions that attract less scrutiny.

- To avoid personal risk: Using mules enables criminals to distance themselves from the illegal activities, reducing their risk of detection and prosecution.

Money Mules in India: The Growing Concern

In recent years, India has seen a rise in money-muling activities, driven by the growth of online banking, digital payment platforms, and increasing internet penetration. Criminal networks target individuals across the country, offering easy money for what seems like a simple task: transferring funds.

In particular, India has become a target for international money-laundering schemes due to:

- Large population and diverse financial landscape: The sheer size of the population makes it easier for criminals to find vulnerable individuals willing to become mules.

- Growth of digital payment platforms: The rapid adoption of mobile payment apps and digital banking has created more opportunities for mules to transfer funds quickly and anonymously.

The Legal Consequences of Being a Money Mule in India

Being a money mule is not a victimless crime. In India, individuals who act as money mules, even if they are unaware of the criminal activity, can face serious legal consequences under various laws, including:

- The Prevention of Money Laundering Act (PMLA) 2002: Money laundering is a serious crime in India, with penalties ranging from hefty fines to imprisonment. Even if you unknowingly assist in laundering money, you could be charged.

- Information Technology Act, 2000: If the illegal transfers involve online platforms or digital payment systems, mules could also face charges under India’s cybercrime laws.

Being implicated as a money muling can severely damage your financial reputation, making it difficult to open new bank accounts, apply for loans, or even secure employment.

How Criminals Recruit Money Mules: Common Techniques

Recruiting mules is an essential part of any money laundering scheme, and criminals employ various methods to lure unsuspecting individuals into these schemes. Here are some of the most common recruitment tactics:

- Fake job offers: Fraudsters often post fake job advertisements online, promising high pay for minimal effort. These jobs typically involve “processing payments” or acting as a “financial manager.”

- Social media platforms: Scammers frequently use social media to reach potential mules, offering lucrative opportunities to students, the unemployed, or those looking for extra income.

- Phishing emails: Some mules are recruited through phishing scams, where they are tricked into providing their bank account details, which are then used for money laundering purposes.

- Romance scams: In some cases, mules are recruited through online romance scams, where fraudsters build trust with victims and eventually convince them to move money on their behalf.

How to Identify a Money Mule Scam

There are several red flags to watch out for when identifying potential money mule scams:

- Too good to be true job offers: Any job that offers high pay for simple tasks like transferring money should be treated with caution.

- Pressure to open a new bank account: Fraudsters may ask you to open a new bank account for the sole purpose of receiving and transferring money.

- Requests for personal financial details: Be wary of anyone asking for your bank account details or urging you to share personal information in exchange for compensation.

- Foreign transactions: If you are asked to transfer money to or from overseas accounts, especially from unfamiliar sources, it’s a red flag.

How to Protect Yourself from Becoming a Money Mule

To avoid being caught up in a money mule scheme, take the following precautions:

- Research any job offer thoroughly: If a job involves transferring money or receiving funds into your account, do your homework. Look for reviews or complaints online to determine if the company is legitimate.

- Never share your bank details: Avoid sharing your personal or bank account information with anyone unless you know their intentions.

- Report suspicious activity: If you suspect that a money muling recruiter is targeting you, report it

Read other blogs of Limelightlog