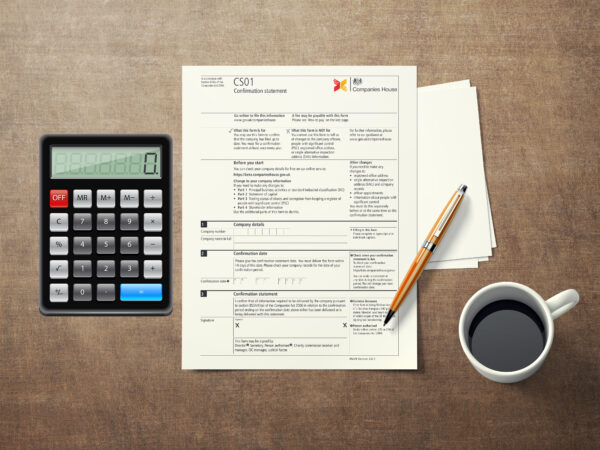

When it comes to maintaining compliance in the corporate world, understanding essential documentation is crucial. One such important document is the CS01, also known as the Confirmation Statement. So, what is CS01? Simply put, it’s a mandatory filing that UK companies must submit to Companies House each year. The CS01 contains vital information about the company’s directors, shareholders, and other statutory details, ensuring that the public record is up-to-date. This filing helps maintain transparency and keeps the company in good standing with regulatory bodies.

What You Need to Know About the CS 01 Form

The CS01 is completed using the CS 01 form, which companies must submit either online or via paper submission. The CS 01 form is straightforward but requires accuracy in detailing the company’s information. This form asks for details such as the company’s registered office, the type of business activities, the details of directors and shareholders, and the company’s share capital. Ensuring that the CS 01 form is filled out correctly is vital, as any errors could lead to complications with the company’s compliance status.

Why the CS01 is Crucial for Your Business

Failing to file the CS01 on time can result in penalties and could even lead to the company being struck off the register. Therefore, it’s essential for company directors to be aware of their responsibilities regarding the CS01 and to ensure that the necessary information is accurate and up-to-date. By doing so, companies can avoid unnecessary fines and maintain their operational integrity.

How to File the CS01

Filing the CS01 is a straightforward process, especially when done online. Companies can log into the Companies House web portal, complete the CS 01 form, and submit it within minutes. For those who prefer a paper submission, the completed form can be mailed directly to Companies House. It’s recommended to double-check all the details before submission to avoid any delays or issues with the filing.

Common Mistakes to Avoid When Filing the CS01

Even though the CS01 is a routine filing, many companies make avoidable mistakes that can lead to delays or penalties. One common mistake is submitting outdated information, particularly regarding shareholders or directors. Another frequent error is missing the filing deadline, which can result in late fees and other complications. Companies should set reminders and allocate time to review their details thoroughly before submitting the CS 01 form to avoid these issues.

The Importance of Timely Filing

The deadline for filing the CS01 is typically 14 days from the anniversary of the company’s incorporation or the date of the last confirmation statement. Failing to meet this deadline can have serious consequences. Not only will the company incur financial penalties, but persistent non-compliance could lead to the company being removed from the Companies House register. Timely filing of the CS01 ensures that the company remains in good standing and can continue to operate without any legal hindrances.

Tips for a Smooth Filing Process

To ensure a smooth filing process, companies should gather all necessary information well in advance of the deadline. This includes verifying the details of directors, shareholders, and the registered office address. Additionally, companies that have undergone changes in shareholding or business activities should update their records before completing the CS 01 form. Utilizing online filing options can also streamline the process, reducing the likelihood of errors and providing immediate confirmation of submission.

Preparing for Future Filings

As companies grow and evolve, their details may change. This could include adding new directors, changing the registered office, or altering shareholdings. It’s important to keep these changes in mind for future CS01 filings. Companies should maintain a well-organized record of these changes throughout the year to ensure that when it’s time to complete the CS 01 form, all information is readily available and accurate. This proactive approach minimizes the risk of errors and ensures that each filing reflects the most current company structure.

Common Questions About the CS01

1. What happens if I miss the CS01 filing deadline?

Missing the CS01 filing deadline can lead to penalties and may affect the company’s status with Companies House. Persistent non-compliance could result in the company being struck off the register, so it’s crucial to file on time.

2. Can I make corrections after submitting the CS01?

If you realize you’ve made an error after submitting the CS 01 form, it’s important to contact Companies House immediately. In some cases, corrections can be made, but it’s best to ensure accuracy before submission.

3. Is there a fee for filing the CS01?

Yes, there is a fee associated with filing the CS01. The fee varies depending on whether you submit the form online or via paper. Online submissions are generally cheaper and more efficient.

Conclusion: Staying Ahead with the CS01

The CS01 is more than just a regulatory requirement; it’s a reflection of your company’s commitment to transparency and compliance. By understanding what the CS01 is, how to correctly fill out the CS 01 form, and the importance of timely filing, your company can avoid potential pitfalls and maintain a strong, trustworthy public profile. Staying ahead of your filing obligations will ensure that your company continues to operate smoothly and successfully within the legal framework set by Companies House.